Imagine being a freelancer for a minute: Doing what they love, with ease at their homes, hopefully into the comfiest pyjamas ever.

But hold on, that’s just 30-40% of the story.

In reality it’s more about finding work, retaining clients, getting paid, and paying taxes too.

Like playing 8-10 roles at once – freelancer, CEO, CFO, account manager, marketer, office manager, and accountant.

Quite overwhelming, isn’t it?

That’s why, I’ve crafted this comprehensive guide freelance invoicing to make their life a bit easier.

But before that, let’s begin by understanding what an INVOICE actually is.

What Is An Invoice?

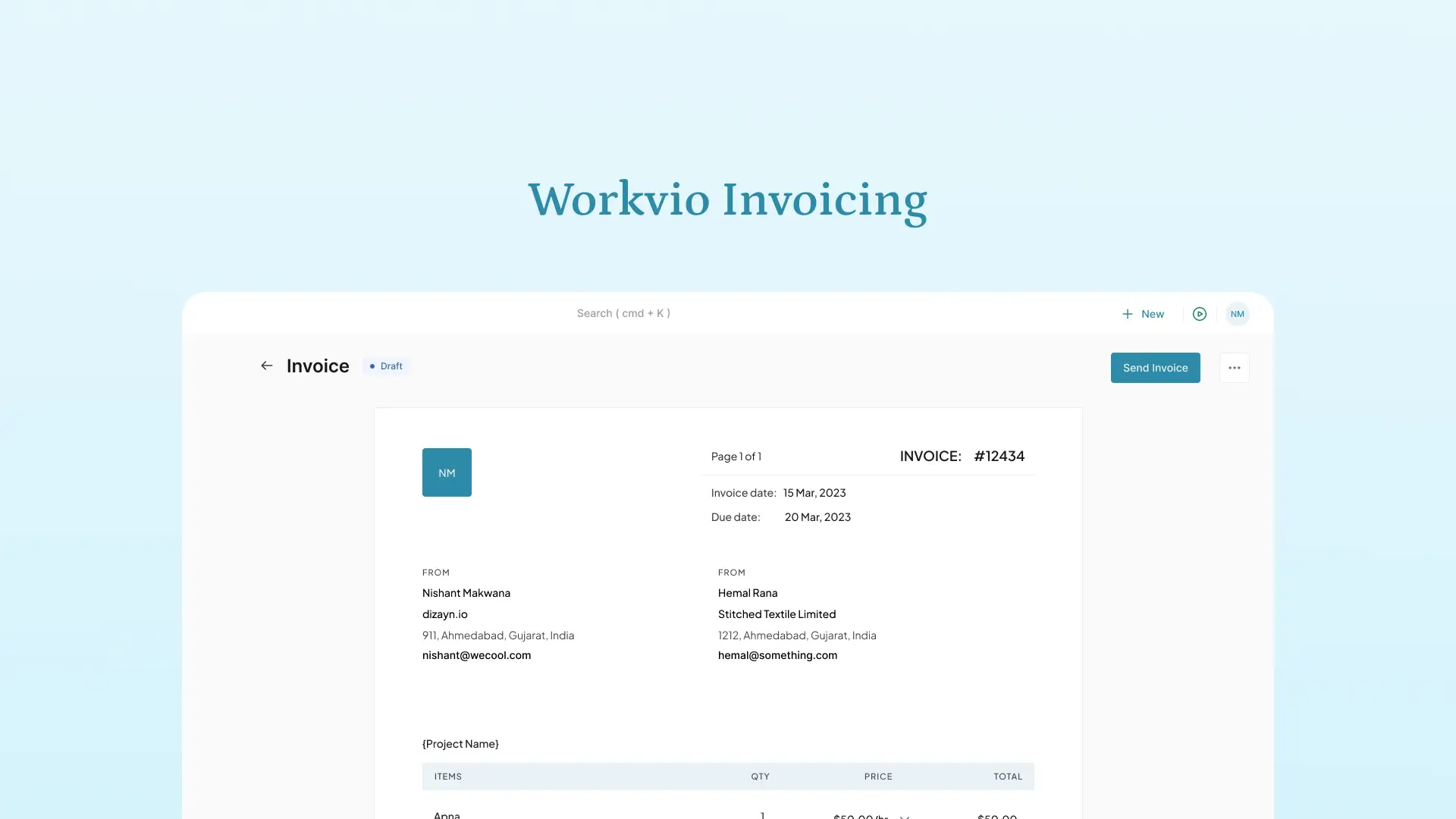

In its simplest form, the freelance invoice format of an invoice is a bill sent to your client or employer that includes:

- Both parties’ contact details

- Invoice date

- Invoice number

- Description of services

- Payment details

- Payment due date

- Terms and conditions

Beyond making a payment request, an invoice also helps in record keeping. It helps you track your earnings, manage cash flow, and prepare taxes. Moreover, in a payment dispute, an invoice is a crucial piece of evidence to help resolve the issue.

Here’s a picture of how a Freelance Invoice Template looks like:

And if someone ever told you, that there’s ONLY one type of Invoice exists.

Consider that a lie.

There are different types of Invoices for catering specific needs. Let’s explore to find the best fit for your freelance business.

Types of Invoices For Freelancers

Here’re 5 most common types of Invoices:

Standard Invoice:

These are the most common types of invoice. Standard invoices include the basic details of a transaction, like the services provided, the amount due, the issue date, and the payment due date.

Timesheet Invoice:

These invoices provide a clear and thorough record of work done, making them perfect for projects where payment is based on time spent.

Pro Forma Invoice:

This invoice is issued to outline the estimated cost of the services to be provided. It helps to set expectations for the client and allow them to prepare for the cost in advance.

Interim Invoice:

Instead of billing for the entire project at once, you can send interim invoices at different project milestones. This approach helps maintain a steady cash flow and makes payments more manageable, especially in cases where a single final invoice isn’t possible.

E-Invoice:

An E-Invoice is a digital invoice sent and processed electronically, providing an instant, environmentally-friendly way for freelancers to bill clients.

Now that you know the types, let’s dive into the essential components every invoice should include because no matter which invoice you use, you must take care of essential components.

Essential Elements To Include In An Invoice

When you consider essential elements, here are 5 key elements to keep in mind:

Your Name and Contact Information:

This should include your full name or your business name, your address, phone number, and email. This helps the client know who the invoice is coming from and allows them to contact you for any queries or issues.

The Client’s Info:

You should include the client’s name and contact information like your own. This ensures the invoice reaches the correct person or department within the client’s organization.

A Unique Invoice Number:

Each invoice should have a unique number for identification purposes. This helps track and organize your invoices and is especially helpful if a payment issue arises.

Issue Date/Due Date:

The issue date is when the invoice is sent, and the due date is when the payment is expected. Clearly stating both these dates helps to establish when payment is due and can help avoid any misunderstanding.

Description:

This is the detailed description of the services you have provided or the work you have done. Each service should be listed as a separate line item, with a brief description and associated cost.

While taking care of essential elements, make sure to address common mishaps that often occur during the invoicing process. Identifying and rectifying these mistakes is crucial to maintaining professionalism and ensuring timely payments.

Common Mistakes To Avoid When Invoicing

- Getting the Wrong Information: Double-check the details on the invoice and make sure they are accurate, both yours and the clients’.

- Generating a Vague Invoice: Be more specific with the details of your invoice to avoid misunderstandings.

- Providing Incorrect Payment methods and Information: Your invoice should include clear instructions on how to make a payment.

- Failing to Follow-Up: Sometimes, clients need a gentle reminder to settle their dues. Don’t hesitate to send a friendly follow-up email.

- Not Using the Right Kind of Invoice: Different types of invoices are used for different situations. Make sure you’re using the most appropriate.

Even after taking care of all these mistakes, the number one mistake newbie (and even experienced) freelance writers make is not keeping your invoices, taxes, and other important documents consistently organized.

But worry not.

Here’re 5 Invoicing software to take help from.

5 Invoicing Software To Try

1. FreshBooks

It’s an accounting and invoicing software that caters the needs of creatives and freelancers. It’s free for the first 30 days. Not just this, you can also customize invoices from adding your logo to personalizing your thank-you email.

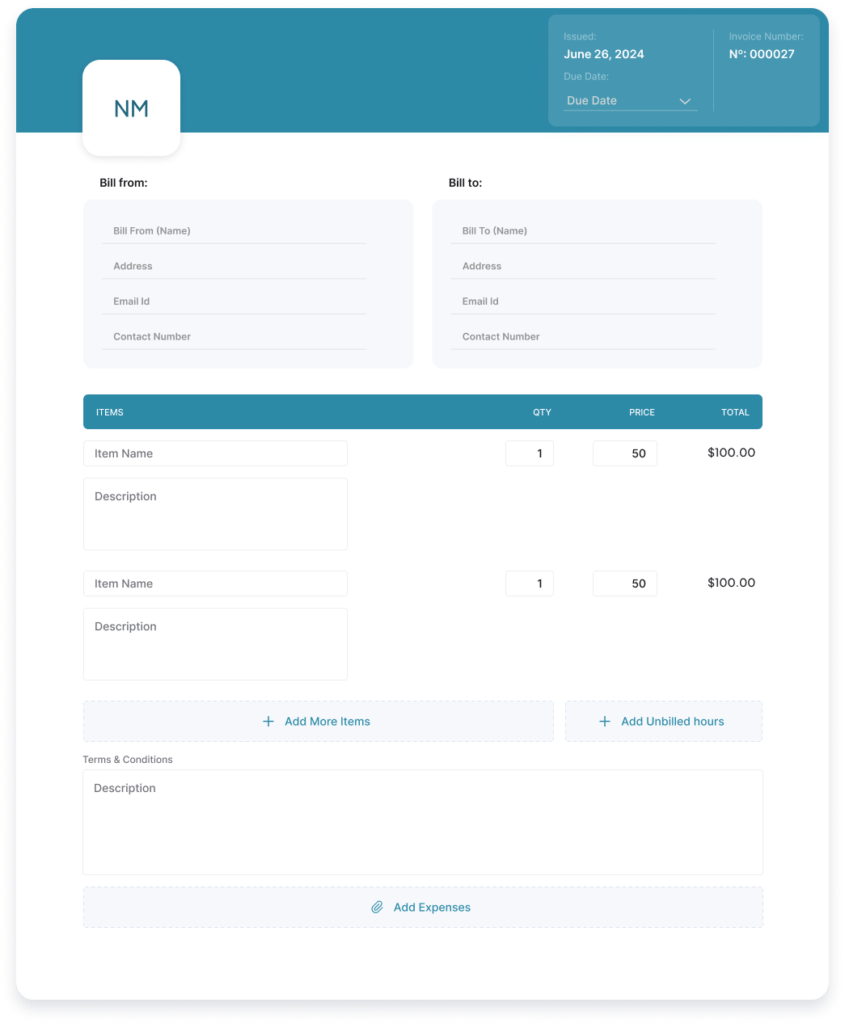

2. Workvio

It’s a must-have tool for freelancers, helping them work smarter, stay organized, and get more done. With features for task management, time tracking, and easy invoicing, it’s the perfect solution for streamlining your workflow.

3. Wave

If you’re looking for comprehensive accounting and invoicing software that’s free, you can’t get any better than Wave. It works great if you just need simple software to create consistent invoices.

4. Less Accounting

It’s designed to streamline accounting processes for freelancers, Independent contractors, consultants, and small businesses.

5. Hiveage

Hiveage Free allows you to create and send as many invoices as you’d like (but no recurring invoice). It’s one of the best software options to use on a pay-as-you-go basis to determine what works best for your business needs.

Conclusion

Often, many freelancers overlook the significance of invoicing, assuming it’s either too complicated or just a formality. This misconception can result in delayed payments, confusion, and even disagreements with clients.

Having a well-organized invoice can be transformative. It provides a clear record of transactions, boosts project management, and facilitates timely cash flow, fostering a professional relationship between you and your clients.

It’s not just about sending bills; it’s a critical aspect of freelancing that ensures financial stability and transparency. By mastering the art of effective invoicing, freelancers can navigate their businesses with confidence and efficiency.